Credits: CCH Tax Online

Fair Market Value of Shares as on 01.02.2018

Credits: CCH Tax Online

Introduction Cryptocurrencies are decentralised, virtual, or digital currencies which are neither backed by any Government nor regulated by any Central Bank (like RBI). These currencies have gained popularity as they provide anonymity and is a secure way of transacting. Bitcoin is one of the types of cryptocurrencies and was founded in 2009 by an unknown… Continue reading Taxation on Mining of Bitcoins (Cryptocurrency)

Highlights related to Income tax amendments applicable via the Budget 2022 announced on 01.02.2022

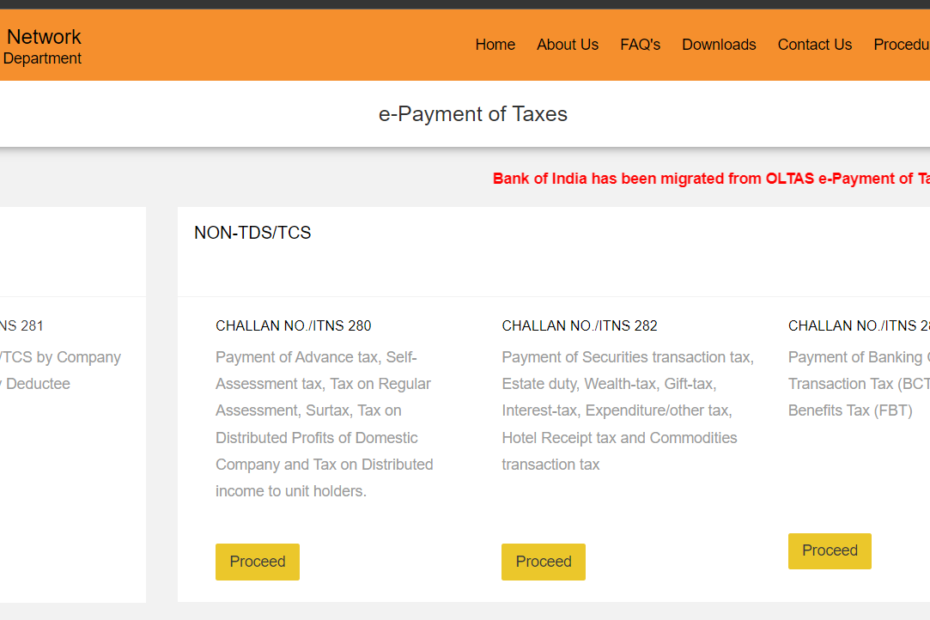

Step # 1: Visit the website https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp Step # 2: Select CHALLAN NO./ITNS 280 Step # 3: Fill in the Details Precautions to be taken while filling the Challan a) Assessment Year : If you are paying advance tax for the Financial Year 2022 – 2023 then select Assessment Year as 2023 – 2024 b)… Continue reading Advance Tax Payment Procedure

Notification No G.S.R. 700(E) Dated 15th September, 2022 The Ministry of Corporate Affairs has revised the limits of paid up capital and turnover for attaining the status of a Small Company. The turnover limit has been inceased from Rs.20 Crores to Rs.40 Crores & Share Capital limit has been increased from Rs.2 Crores to Rs.4… Continue reading Small Company – Updated Limits

Highlights – EMPLOYEES EARNING SALARY UPTO RS.25,000 ARE EXEMPTED FROM PAYMENT OF PROFESSION TAX W.E.F 01.04.2023