Udyam Aadhar has been formulated by the Government in place of existing Udyog Aadhar with the following major changes:

- Data about the Investment made in the business which earlier used to be self declaration is now captured from the income tax returns filed by the respective business.

- Turnover is now captured from the GST website based on the filings done by the business.

- Automatic classification will be done accordingly.

Updated on 18.08.2020

Currently businesses that haven’t obtained udyog aadhar or MSME registration can obtain the udyam aadhar registration.

Udyog Aadhar has validity upto 31.03.2021 and all businesses having udyog aadhar are supposed to re-register before the said date.

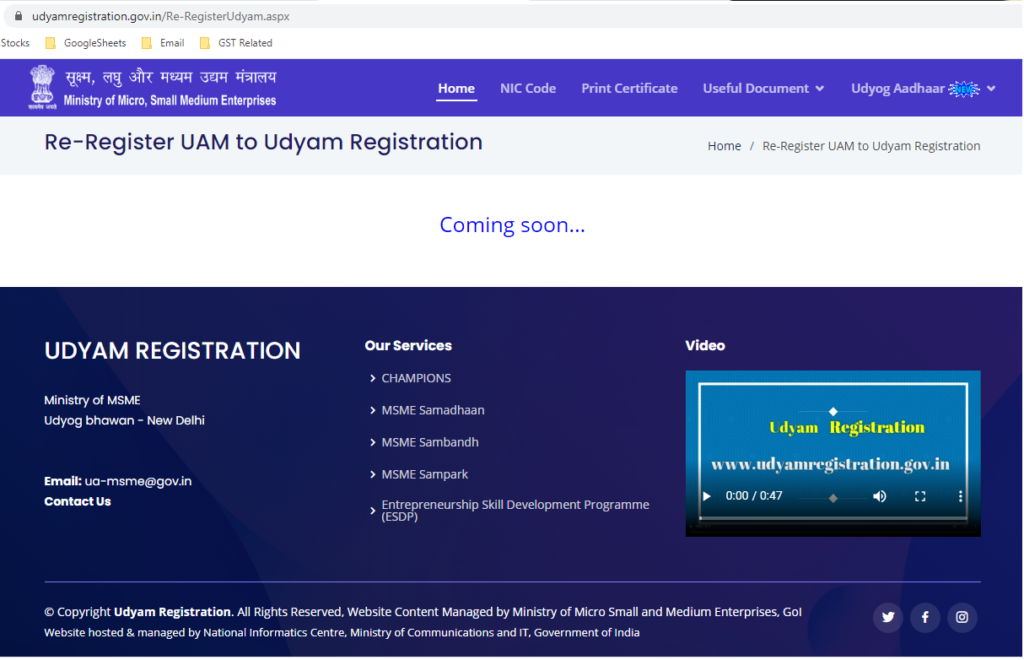

Currently the option to re-register is not working. Check this post for further updates.

Udyam Aadhar re-registration page – COMING SOON status

Documents required for Udyam Aadhar registration:

- Aadhar Card copy of the Proprietor / Partner / Director

- GST No.

- PAN No. of the Proprietor / Partnership Firm / Company

- Bank account details

- Address of the units

- Activities / Products dealt by the Company (NIC Codes)

- No. of employees

Following is a help file shared in the udyamregistration website on how to obtain the registration.

Udhyamaadhar WorkflowNote: Retail & wholesale businesses are not covered under Udyam Aadhar

Kindly use the comments section or email me at ca.praveen@prsrglobal.com for any further details.