[A] INTRODUCTION The finance act of 2018 brought about a change in the way Long Term Capital Gain [LTCG] on listed equity shares & Units

This is the first of the series of articles that we are prepared to post related to Capital Gains. There are five heads of income

The attached file can be use for registration under GST if the said property used for the registration is not rented but owned by any

The board resolution format attached herewith for authorisation of Director / Directors of the company for GST Registration. Has to be printed on letter head

To be signed and uploaded with the GST application for registration.

Particulars Original Due Date Extended Due Date Statement of Financial Transactions – Rule 114E 31st May 2021 30th June 2021 Statement of Deduction of Tax

Background of the case Applicant is the business of manufacturing and supply of auto parts. Company is mandated under the Factories Act 1948 to provide

Sl.No. Nature of Transaction Reporting Person 1. Capital Gains on transfer of securities listed on any recognised stock exchange in India Recognised Stock Exchange;Depository as

Introduction: The High Court held that ITC availed by the buyer cannot be reversed on the account of seller’s failure to deposit the tax collected

Income Tax Due date for filing TDS Returns extended from 30th of June 2021 to 15th July 2021 Due date for issue of TDS Certificates

Meaning of Small company and the related benefits / relaxation provided to it with updated definition for small company

Concise information about – New Annual Information System to replace the Form 26AS.

Sl. No. Financial Year Cost Inflation Index (1) (2) (3) 1 2001-02 100 2 2002-03 105 3 2003-04 109 4 2004-05 113 5 2005-06 117

Credits: CCH Tax Online

Introduction Cryptocurrencies are decentralised, virtual, or digital currencies which are neither backed by any Government nor regulated by any Central Bank (like RBI). These currencies

Highlights related to Income tax amendments applicable via the Budget 2022 announced on 01.02.2022

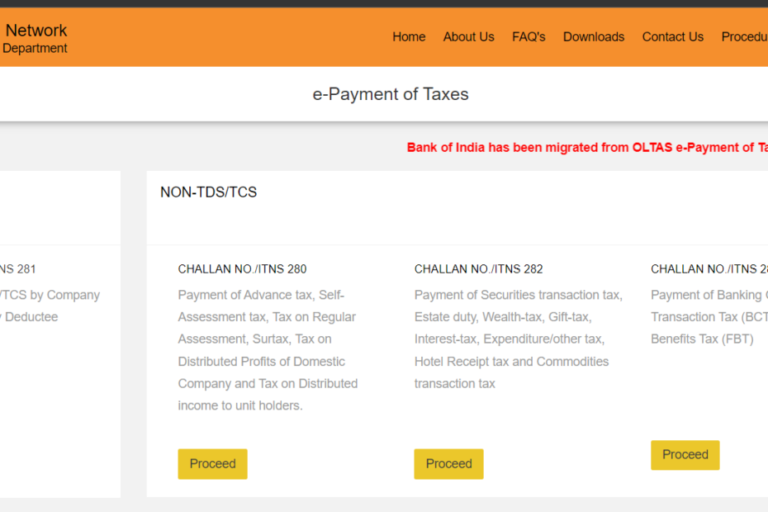

Step # 1: Visit the website https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp Step # 2: Select CHALLAN NO./ITNS 280 Step # 3: Fill in the Details Precautions to be taken

Notification No G.S.R. 700(E) Dated 15th September, 2022 The Ministry of Corporate Affairs has revised the limits of paid up capital and turnover for attaining

Highlights – EMPLOYEES EARNING SALARY UPTO RS.25,000 ARE EXEMPTED FROM PAYMENT OF PROFESSION TAX W.E.F 01.04.2023

P R S R & Co, approach works on the foundation that every client is equal and every problem has a solution. We have diverse backgrounds which helps us to provide services ranging from a chai-wala to a company listed on the stock exchange.