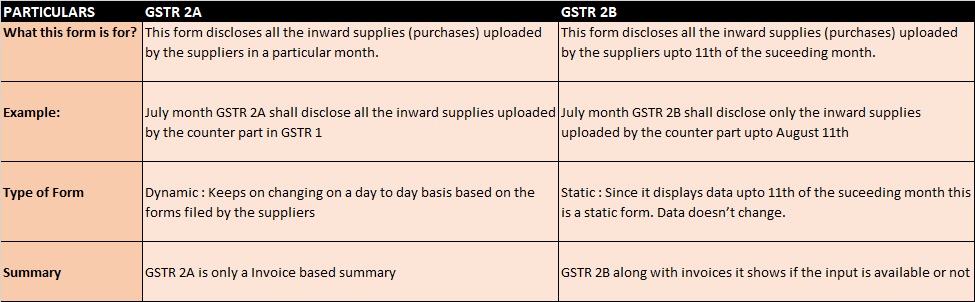

GSTR 2B will be available from July 2020 onwards. Its an auto generated statement based on the data available from GSTR 1 filed by suppliers, ICEGATE portal, Reverse Charge document and so on. It also provides details on whether the credit is available or not.

This is a step forward by the GST department to bring in automated GSTR 3B. Its imperative now to start filing GSTR 1 on monthly basis to avoid calls from customers and clients. Its also important to reconcile the books of accounts with GSTR 2B to make sure the suppliers have filed GSTR 1 on time.